Becoming A Client

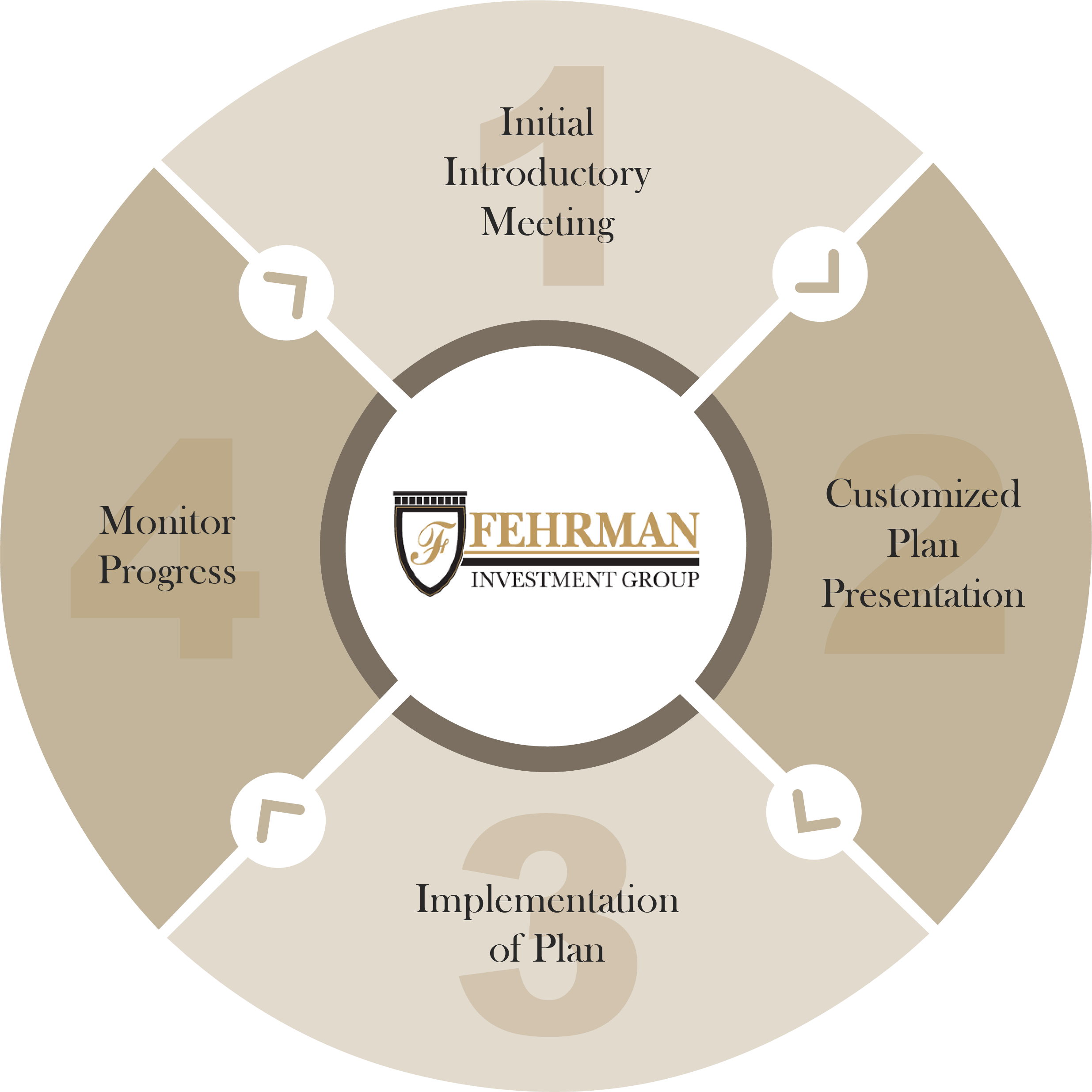

Our 4-Step Process

Our goal is to build a long-term relationship that helps to educate you on alternatives to your current plan and to develop comprehensive financial strategies to help you accomplish your goals.

Step 1- Initial (Introductory) Meeting

- Meet our Team

- Understand Benefits to you

- Data Checklist (see below)

- Mutual Fund and Brokerage Account

- Company Retirement Accounts – Current and Former

- Current Pension

- Current IRA Statement

- Current Life Insurance Coverage

- Mortgage Information

- Estimated Retirement Date

- Expectations Review

- Overview of Investment Approach

Step 2- Customized Plan Presentation - Meeting Your Goals

- Retirement Plan

- Asset Review

- Comprehensive Plan

- Progress Assesment to goals

- Education of Investment Options

Step 3- Implementation of Plan

- Discussion from plan education of best approach

- New Account Set Up

- Account Transfers-We handle the transfer for you

- Movement Set Up

- Retirement Plan Distribution

- Tax Basis Sensitivity Analysis

Step 4- Review Progress

- Systematic Periodic Scheduled Account Reviews

- Educational Opportunities

- Lifestyle Updates

- Required Minimum Distributions

- Performance Reviews

Initial Meeting Data Checklist

- Cash, CD and Money Market Balances

- Mutual Fund and Brokerage

- Account Statements

- Company Retirement

- Accounts-Current and Former

- Current Pension

- Current IRA Statement

- Current Life Insurance Coverage

- Mortgage Information

- Estimated Retirement Date